Quantitative Notes (Page 3 of 4)

Dynamic Analysis of Tax Cuts and Jobs Act

This Quantitative Note uses the OG-USA open source dynamic general equilibrium overlapping generations model to simulate the effect of the Tax Cuts and Jobs Act. We simulate this reform under the assumptions of a closed economy and small open economy. In both cases, the TCJA reform causes significant growth in GDP and employment between 1% and 2% per year in the first 8 years. However, the increasing debt-to-GDP ratio quickly crowds out investment and causes a drag on the economy. Wage growth can range from nearly nonexistent to a modest 0.6%, depending critically on the assumption of how much capital will flow into the country.

Full Text →

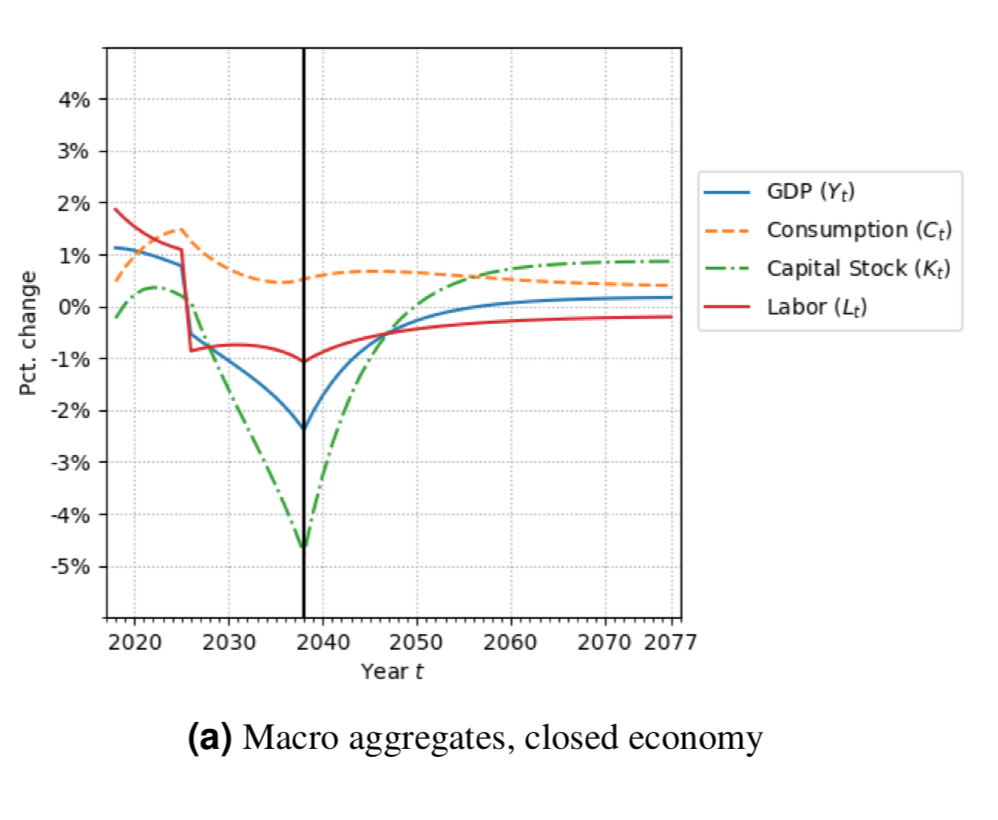

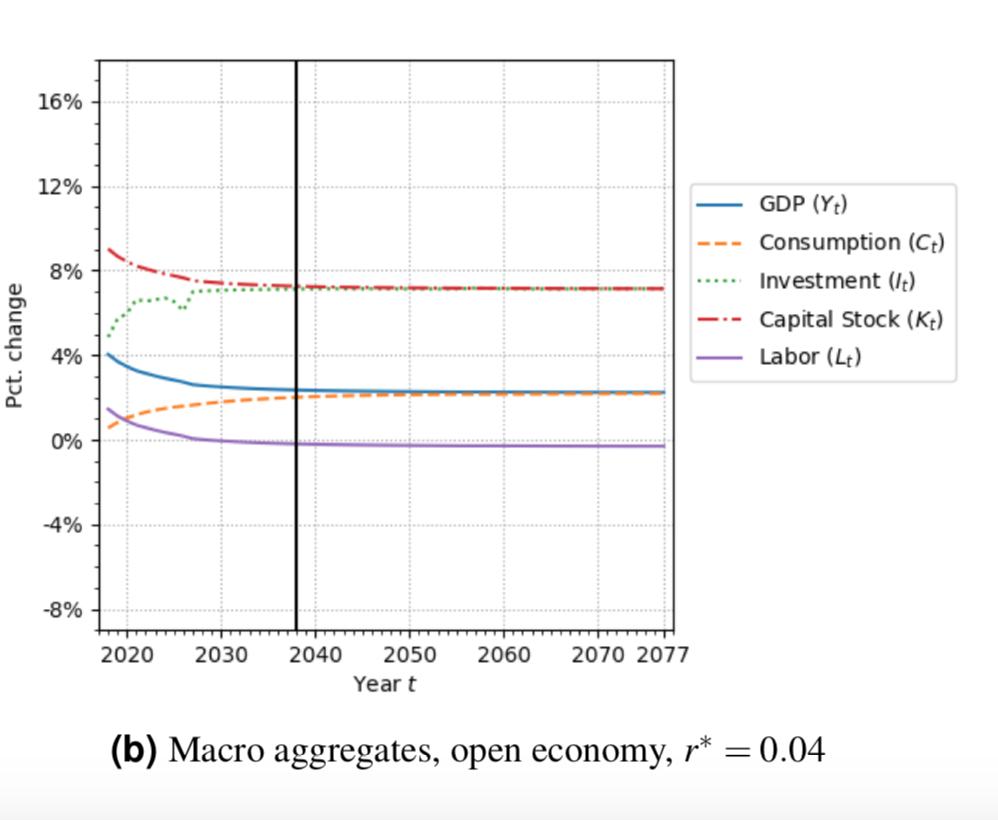

Dynamic Analysis of Corporate Income Tax Rate Cut

This Quantitative Note uses the OG-USA open source dynamic general equilibrium overlap- ping generations model to simulate the effect of cutting the U.S. corporate income tax rate from 35% to 20%. I simulate this rate cut under the assumptions of a closed economy and small open economy, respectively. In both cases, the corporate rate cut causes government revenues to decrease and the debt-to-GDP ratio to increase. In the small open economy scenario, GDP and wages increase by around 3.0%, and 2.5%, respectively. However, in the closed economy setting in which the increased debt service must be satisfied by domestic savings (crowding out), the GDP and wage gains are much smaller and short lived.

Full Text →

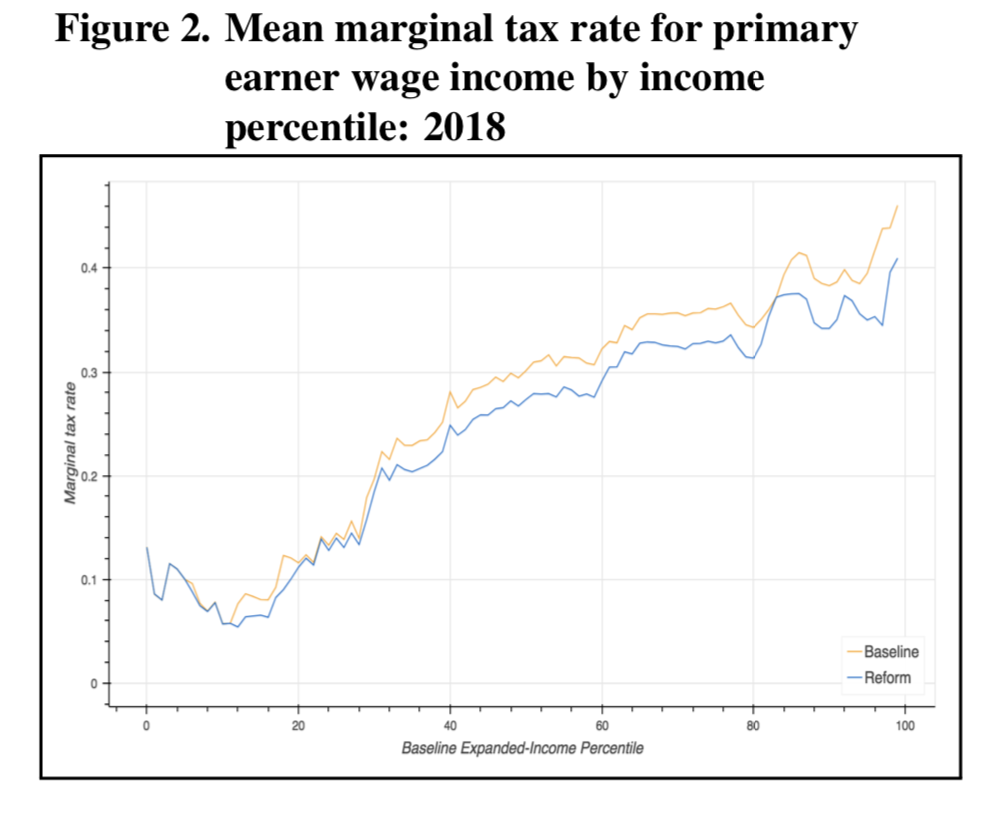

Government Revenue and Distributional Effects of Tax Cuts and Jobs Act

We simulate the effects of the Tax Cuts and Jobs Act (TCJA) using the Tax-Calculator open source microsimulation model. Our simulation predicts that the TCJA will reduce government revenues by nearly $460 billion over the next 10 years without factoring in the additional lost revenue from cutting the corporate income tax rate, reducing the estate tax, and removing the individual mandate provision of the Affordable Care Act. We also describe the effects of the TCJA on the distribution of tax filers.

Full Text →