Quantitative Notes

Revenue and Distributional Impacts of the American Rescue Plan Act

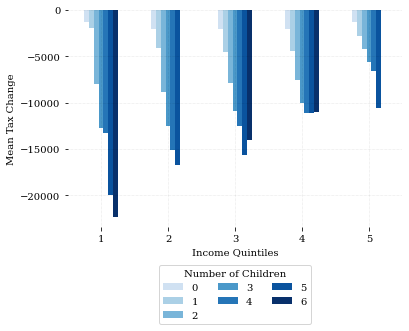

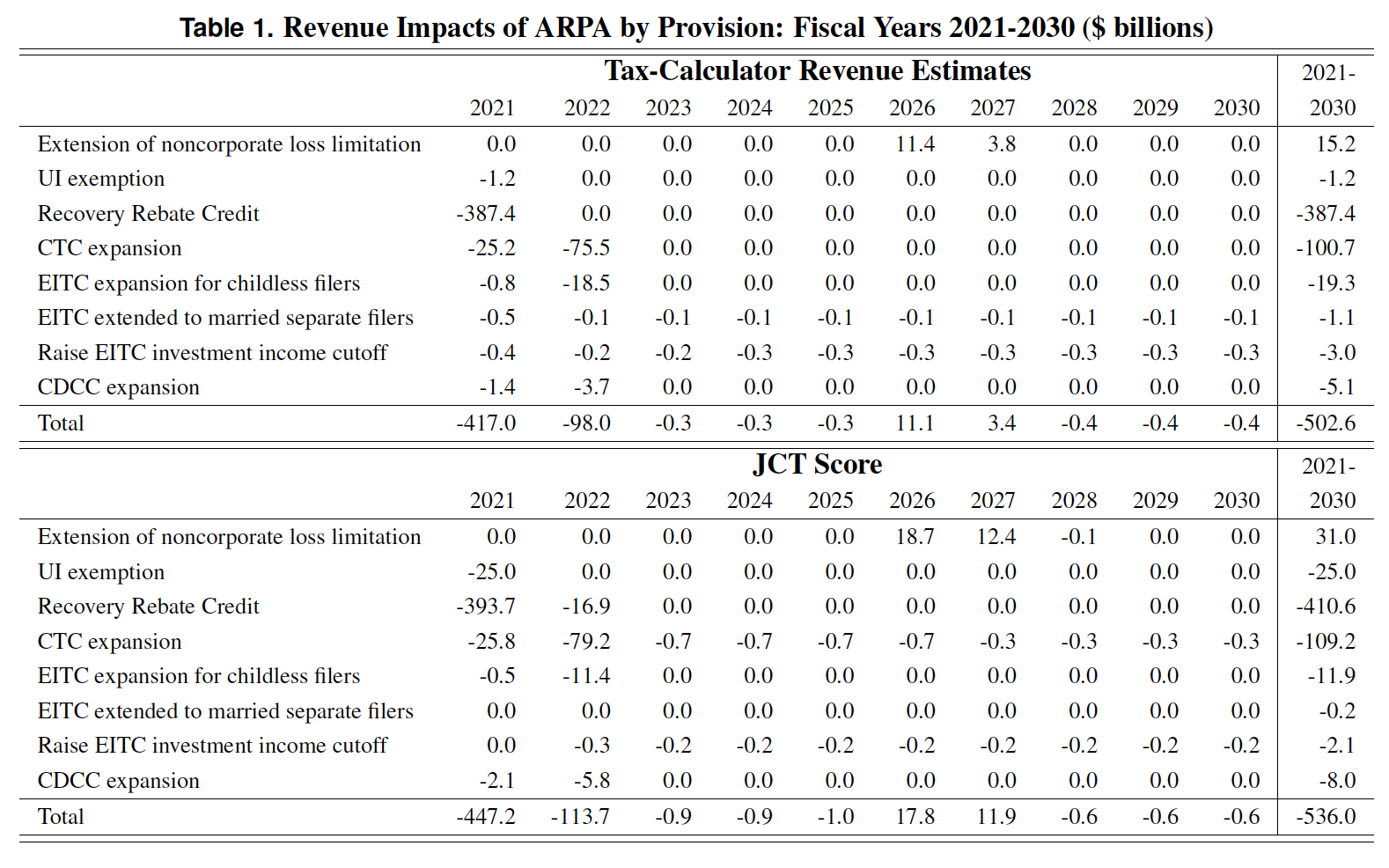

The American Rescue Plan Act of 2021 provides over half a trillion dollars in tax benefits to Americans. We illustrate how the Act provides substantial tax benefits to the lowest income Americans. It also keeps a Biden campaign promise of not raising taxes on American taxpayers making less than $400,000 per year, although some higher earning tax payers face increased tax liability due to ARPA.

Full Text →

Simulating Effects of the American Rescue Plan Act

This Quantitative Note describes the new reform file ARPA.json for simulating the American Rescue Plan Act (ARPA) of 2021 using the Tax-Calculator open-source microsimulation model of U.S. personal income taxes and payroll taxes, as well as multiple other open-source policy models in the Policy Simulation Library community.

Full Text →

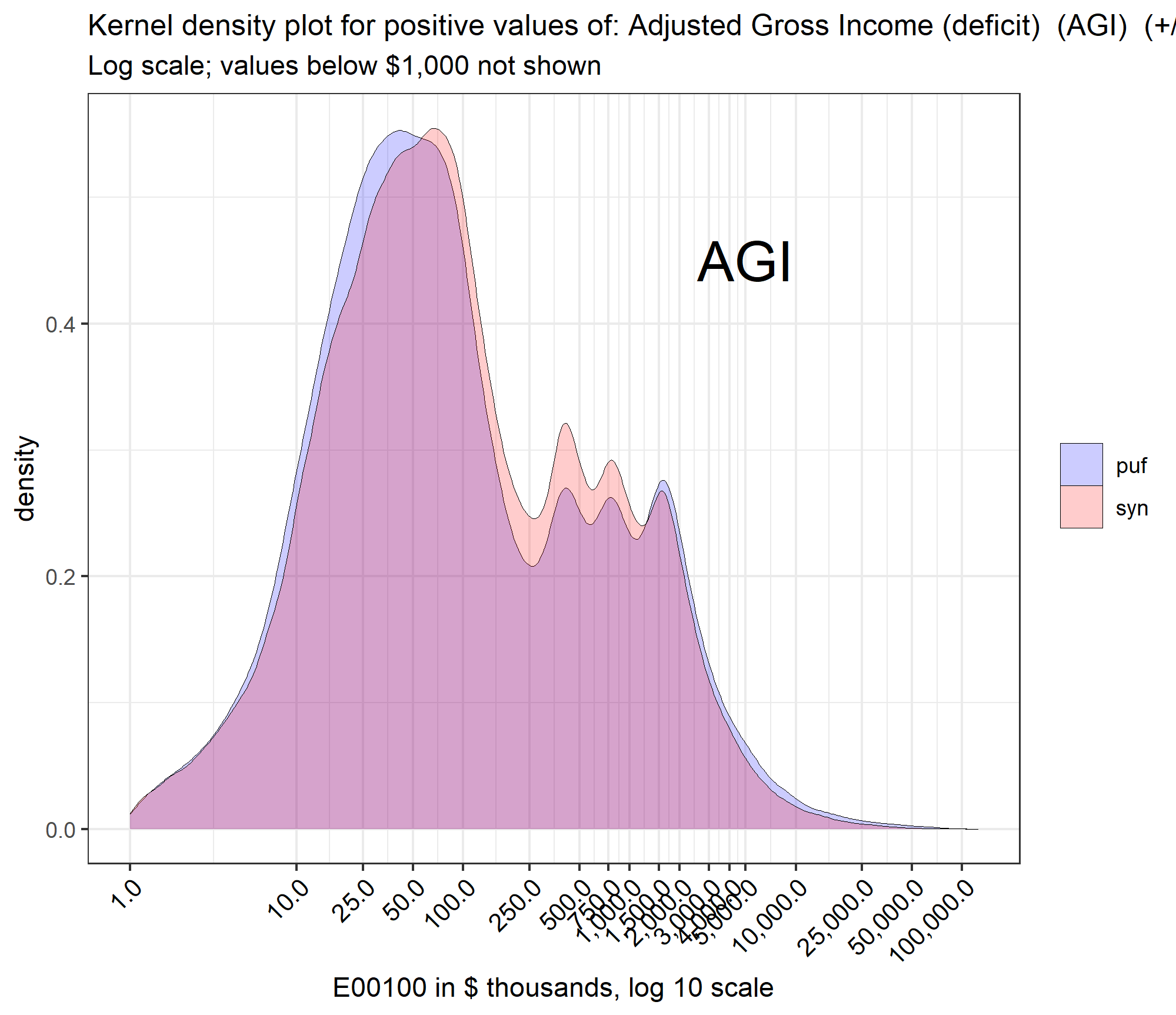

A New Synthetic Data Set for Tax Policy Analysis

Colleagues and I developed a synthetic federal income tax microdata file, with support from the Open Source Policy Center. We synthesized the file using random forests and constructed record weights that minimize differences between targets developed from the IRS public use file and corresponding weighted values from the synthetic file. The file is quite useful for some tax policy analysis purposes but less useful for others. We intend to improve file quality in future iterations. We are preparing the file and documentation for use with the Policy Simulation Library’s Tax-Calculator federal income tax model, for free and without legal restrictions.

Full Text →

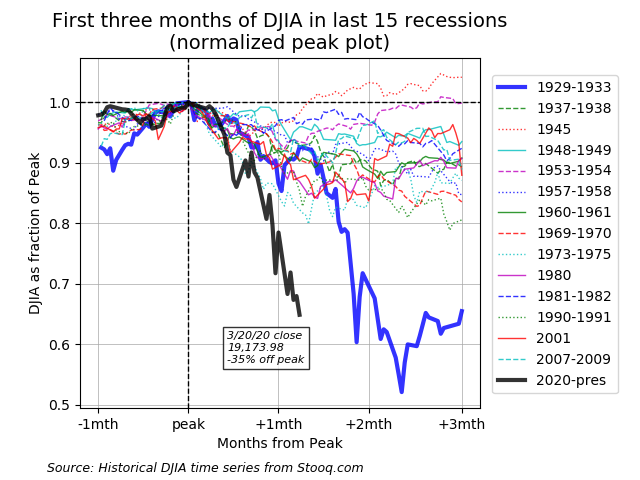

Stock Price Perspective on Coronavirus Crash

This Quantitative Note provides evidence that the initial economic effects of the coronavirus pandemic in the United States are worse than any of the last 15 recessions, including the Great Depression. Specifically, average stock prices as measured by the Dow Jones Industrial Average (DJIA) have fallen faster in the last 37 days than in any previous five-week period at the beginning of a recession in the last 100 years. The current 35% decline of the DJIA compares with a decline of roughly 10% over the same period at the outset of the Great Depression. The hope is that this current shock will not last as long as the worst recessions of the past and will not depress stock prices as deeply.

Full Text →